Tax. No one wants to pay it but everyone wants what it is able to provide. That’s life.

What also seems to be life, in this modern world, is that the Nationalists seem to keep upsetting the Unionists.

Last week this was extremely evident at the budget presentation. The unionists thought they had all worked out what was going to happen and had all prepared their speeches beforehand. Nasty nationalists had not leaked what their intentions were. Result…………….very embarrassing, unionist leaders were unable to think on their feet. They read out their prepared statements and as such, much of what they said was irrelevant. They seemed to think there were only 2 alternatives. Not to raise taxes or to raise by 5p for the higher earners.

This is why the SNP are still the governing party. They step back from the way it has always been done and think out of the box. Why could there only be 2 alternatives? Simply because that’s what the other parties keep saying? All of these parties have been in government in Westminster and Westminster is well over its head in debt.

At each cost cutting made by Westminster the cry from the unionist parties in Scotland has been to use powers to cushion the blow to the people of Scotland. In some circumstances the Scottish government has managed this from their budget given by Westminster. When there was no more wriggle room the Tories shouted to use the tax raising powers. Sounds good shouting it in the debating chamber, but turns out the Tories don’t want to pay any more taxes. Labour aren’t too keen on it either. So what is the alternative? Keep borrowing till we can no longer afford to pay back? Is this the Tory plan, to bankrupt the Scottish government and then do away with it?

At the moment I do not benefit from many of the free things that is making life more bearable for many people in Scotland, BUT some of my loved ones do. I would not like to remove them because we can no longer afford them. I would rather pay a few more pounds a year to ensure my loved ones are comfortable. In the case of prescription charges, bringing these back would result in the early deaths of many people who could not afford all their multiple prescriptions. Better to do without an expensive luxury that you do not really need rather than see your loved ones struggle to control their medical condition because they cannot afford all their medications. Then again maybe you would be kind enough to pay their prescriptions for them.

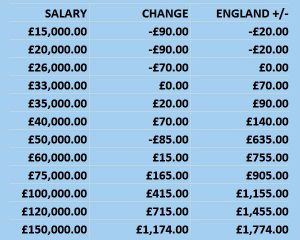

I came across a neat table on social media the other day that explains how much each pay category would be affected by the budget. Not really as bad as the Tories are making out, is it?

I received a press release on Monday that listed some of the myths the Tories are telling and the busted replies. You may be interested so I am including it here. Feel free to share this information.

TORY FACT CHECK

TORY CLAIM #1:

Ruth Davidson: “Workers across Scotland are going to have to pay more tax than those in the rest of the UK.”

FACT CHECK:

A majority of taxpayers in Scotland – 55% – will pay less tax in Scotland than in the rest of the UK.

TORY CLAIM #2:

Murdo Fraser: “Derek Mackay’s announcement confirmed that anyone in Scotland earning over £26,000 would be hit by higher taxes.”

FACT CHECK:

Someone earning £26k will pay LESS tax next year than they do this year. Nobody earning less than £33k, some £5k above the average full-time salary, will pay more income tax next year.

TORY CLAIM #3:

Murdo Fraser: “Whilst we all agree that the broadest shoulders should bear the biggest burden, this should only happen if tax revenues increase and so far evidence suggests otherwise.”

FACT CHECK:

Our decisions made on tax will raise £362 million to spend on public services.

The Scottish Fiscal Commission project tax revenue to increase in each year for the next 5 years.

Click here for the summary of tax forecasts.

TORY CLAIM #4:

Jamie Greene: “A Nat Tax on anyone earning over £24 grand”

FACT CHECK:

Someone earning £24k will play LESS tax next year than they do this year. The introduction of two new bands – a 19p starter band at £11,850 and an intermediate 21p band at £24k – make the tax system fairer and more proportionate to ability to pay.

As all taxpayers benefit from the lower starter band, you will need to earn £33k or more to pay more income tax – not £24k.

TORY CLAIM #5

Dean Lockhart: “Already hit by council tax rises and LBTT, these highly skilled workers may well go elsewhere.”

FACT CHECK:

Council Tax bills are lower in Scotland than in England by an average of £300-400. This is just one of the reasons why taxpayers in Scotland get the best deal in the UK.

LBTT is a progressive replacement for Stamp Duty, which saw 90% of tax payers better or no worse off than under UK Stamp Duty Land Tax at its introduction. It was announced in the budget that first time buyers will benefit from LBTT relief up to £175,000, taking 80% of first-time buyers out of LBTT altogether.

Finally, this will be the last blog before Christmas. We at the Scots Independent (on-line and newspaper) would like to wish all our readers and subscribers a Merry Christmas and a Happy New Year. Thanks for being with us and supporting us. Here’s to another year of spreading the pro independence cause, and remember to nip those Tory lies in the bud at all your festive gatherings.

I would just like to wish ALL at the Scots Independent a Very merry Christmas and a joyful and successful new Year. keep up the good work

Thank you James. Much appreciated. All the best to you too

Always a good read, more in 2018 please

Thanks Colin. Hoping to keep the gang together ?